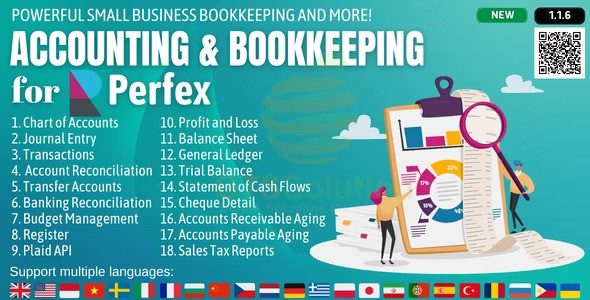

Accounting and Bookkeeping module for Perfex CRM Nulled Script 1.3.0

Short description

Accounting involves recording and tracking financial statements to assess an entity’s financial health. It involves bookkeeping and analysis of transactions, including purchases, sales, and receipts. Analyzing these transactions into reports, such as profit/loss statements, cash flow reports, and sales tax tracking, helps small business owners make informed decisions. Proper accounting and bookkeeping can improve decision-making in small businesses.

This module simplifies the process of manual data entry, prevents errors, and aids businesses and accountants during tax time. It consolidates all financial reports into one online system, ensuring accuracy and efficiency in financial reporting. The module features a dashboard with Profit & Loss Chart, Income Chart, Expense Chart, Cashflow Chart, and Bank Accounts Overview.

Banking includes banking register, posted bank transactions, reconciliation, import bank transactions, and import bank transactions. Transactions are mapped to accounting, including bank statements, invoices, payments, expenses, purchases, inventory, and payroll. The module also offers item mapping, expense category mapping, tax mapping, purchasing mapping, and inventory mapping setups.

Budgets Management supports preparing budgets, helping monitor, track, and compare expected income and expenses with actual income and expenses. Business overview reports include Balance Sheet Comparison, Balance Sheet Detail, Balance Sheet Summary, Custom Summary Report, Profit and Loss as % of total income, Profit and Loss Year-to-date comparison, Statement of Cash Flows, and Statement of Changes in Equity.

Bookkeeping reports include Account list, Balance Sheet Comparison, General Ledger, Journal, Profit and Loss Comparison, Account history, Recent Transactions, Statement of Cash Flows, Transaction Detail by Account, Transaction List by Date, Trial Balance, Sales Tax Reports, Sales and Customers Reports, Expenses and Suppliers Reports, and Budgets Reports.

The module comes with included documentation for uploading and activating the module within Perfex CRM. The support team is available to help users with any issues and provides assistance through a support ticket.

description

Accounting and Bookkeeping module for Perfex CRM Nulled Script Accounting is the recording and monitoring of financial statements to determine an entity’s financial health. This is accomplished by entering, categorizing, measuring, and transmitting transactions in a variety of forms. Accounting includes recordkeeping and analysis. Bookkeeping, often known as financial accounting, is the process of documenting transactions such as purchases, sales, and receipts made by a person or organization. Once the bookkeeper has recorded and organized all of the transactions, the next stage in accounting is to evaluate these transactions and create useful reports that reveal the condition of one’s finances. These reports may contain profit/loss statements, cash flow reports, and sales tax tracking to help you stay on top of your tax obligations. With proper small company accounting, small business owners will have a clear picture of the health of their finances, allowing them to make better choices based on the information provided.

Accounting and bookkeeping for Perfex CRM.

youtube

Accounting and Bookkeeping module for Perfex CRM Nulled Script Benefits of an Accounting and Bookkeeping Module

Using this module reduces the effort of manual data input, avoids typical human mistakes, assists companies and accountants when tax time arrives, and enables the user to see detailed information on how their company’s finances are doing. Perhaps the most significant benefit of this module is the amount of time it will save. With this module, all of their financial data will be integrated into a single online system, making it simpler to manage their records. An accounting module for organizations allows you to automate numerous activities, saving time while also ensuring the integrity and efficiency of your financial reporting.

Module Features

Dashboard: Profit and loss, income, expense, cashflow, and bank accounts. Overview

Banking: Register (posted) Bank Transaction.

Reconcile Bank Account Import Banking Transactions:

Mapping Bank Statements to Accounting

Mapping Invoices to Accounting

Mapping Payments to Accounting

Mapping Expenses to Accounting

Mapping Purchase to Accounting (requires integration with Purchase Management module).

Accounting and Bookkeeping module for Perfex CRM Nulled Script Mapping Inventory to Accounting (must interact with Inventory Management module)

Mapping Payroll to Accounting (needs integration with HR Payroll module)

Item Mapping Setup options include expense category mapping, tax mapping, and purchasing mapping. Set up Inventory Mapping. Set up Banking Rules to automatically classify transactions.

Journal Entry: recording transactions in the general ledger.

move: to move funds across accounts.

The Chart of Accounts is a compilation of account numbers and names that are significant to your firm. A chart of accounts typically has four categories: asset accounts, liability accounts, income accounts, and expense accounts.

Reconcile is the process of verifying transactions recorded into the module to your bank or credit card statements.

Budget Management: assists in the preparation of budgets, which allow you to monitor, manage, and compare planned and actual revenue and spending. When you build a budget, you usually make it for a fiscal year, and you may choose to offer budget numbers or utilize historical quantities.

Business Overview Reports:

Balance Sheet Compare what you possess (assets), what you owe (liabilities), and what you invested (equity) to the previous year.

Balance Sheet Detail: a thorough snapshot of your assets, liabilities, and equity.

Balance Sheet Summary: a summary of your assets, liabilities, and equity.

The balance sheet shows what you possess (assets), what you owe (liabilities), and what you have invested (equity).

Custom Summary Report: A report that you create from scratch. With additional choices for customization.

Profit and Loss as a percentage of your revenue: your costs as a proportion of your total income.

Profit and Loss Comparison: your revenue, spending, and net income (profit or loss) compared to the previous year.

Profit & Loss Detail: Profit and Loss Detail

Profit and loss year-to-date comparison: compare your revenue, spending, and net income (profit or loss) to this year’s total.

Profit and loss statements include your revenue, costs, and net income (profit or loss). Also known as an income statement.

Cash Flow Statement: cash inflows and outflows from sales and costs (operational operations), investments, and financing.

Statement of Changes in Equity: A statement of changes in equity.

Bookkeeping Reports:

Account list: includes the name, type, and amount of each account on your chart of accounts.

Balance Sheet Comparison: What you possess (assets), what you owe (liabilities), and what you invested (equity) versus last year.

The balance sheet shows what you possess (assets), what you owe (liabilities), and what you have invested (equity).

The General Ledger contains the initial balance, transactions, and totals for each account in your chart of accounts.

Journal: the debits and credits for each transaction, organized by date.

Profit and Loss Comparison: your revenue, spending, and net income (profit or loss) compared to the previous year.

Profit and loss statements include your revenue, costs, and net income (profit or loss). Also known as an income statement.

Account history.

Recent Transactions: Transactions you produced or updated during the previous four days.

Cash Flow Statement: cash inflows and outflows from sales and costs (operational operations), investments, and financing.

Transaction Detail by Account: shows the transactions and totals for each account in your chart of accounts.

Transaction List by Date: A list of all your transactions sorted by date.

Trial Balance: This report summarizes the debit and credit balances of each account on your chart of accounts for a certain period of time.

Sales Tax Reports:

Tax Detail Report: This report details the transactions that appear in each box of the tax return. Unless you have changed your tax reporting option to cash basis, the report uses accrual accounting.

Tax Liability Report: This report shows how much sales tax you have collected and how much you still owe to tax authorities.

Tax Summary Report: This report provides summary information for each box on the tax return. Unless you have changed your tax reporting option to cash basis, the report uses accrual accounting.

Sales and Customer Reports:

Deposit Details: Your deposits, including the date, customer or supplier, and amount.

Income by Customer Summary: For each customer, subtract your costs to get your net income.

Expense and Supplier Reports:

Cheque Details: The checks you’ve made, including the date, payee, and amount.

Budget overview reports provide a summary of account balances within your budget.

Profit & Loss Budget vs. Actual: This report demonstrates how well you are fulfilling your budget. For each kind of account, the report compares your budgeted and actual amounts.

Profit and loss budget performance: This report compares actual and planned amounts for the month, fiscal year to date, and the yearly budget.

Account Ageing Reports:

Accounts Receivable Aging Summary: Unpaid amounts for each client, organized by days past due.

Accounts Receivable Aging Detail: outstanding invoices sorted by days past due.

Accounts Payable Aging Summary: the total amount of overdue invoices, organized by days past due.

Accounts Payable Aging Detail: A list of your overdue invoices organized by day past due.

Bank Reports:

Bank Reconciliation Summary

Bank Reconciliation Detail Settings:

General Account Detail Types: Management API Setup Demo

Accounting and Bookkeeping Demo

Set-up

If you don’t know how to upload and activate the module within Perfex CRM, the included documentation will show you how.

Support

Our support staff is always here to assist. Feel free to submit a support ticket.

Guys from the support department will come back to you as soon as possible and guide you through any concerns.

Related Products

The Best Products

Product Info

version

Updated Date

Released on

Developer Name

Category

There is a problem ?